When debts keep piling on and you or your business just can’t keep up, declaring bankruptcy may be the best option. While it’s upsetting, stressful, and for many people, embarrassing, a guide to the different types of bankruptcy can help you understand the process and what comes after it.

When you hear about bankruptcy on the news, you’ll often hear it referred to as “Chapter 13” or “Chapter 11.” These refer to different sections of the federal bankruptcy law, 11 United States Code (U.S.C.). Each defines a different type of bankruptcy as it applies to individuals, businesses, farmers, and even municipalities. The code also covers international bankruptcies to give international creditors some recourse when a debtor can’t pay what they owe.

Many residents of the Texas panhandle face rising debt and a sense of panic as creditors are calling incessantly seeking payments. If you are struggling with debt, then don’t worry—you have a lawyer nearby who can help.

Consult an experienced bankruptcy attorney in Amarillo by reaching out to the Northern Law Firm. Get advice on the different types of bankruptcy and which option might be the best route for you to take back to financial stability.

It’s true that filing for bankruptcy affects your creditworthiness, and the effects can last for years. But if you don’t see another way out, bankruptcy can give you a chance to start over.

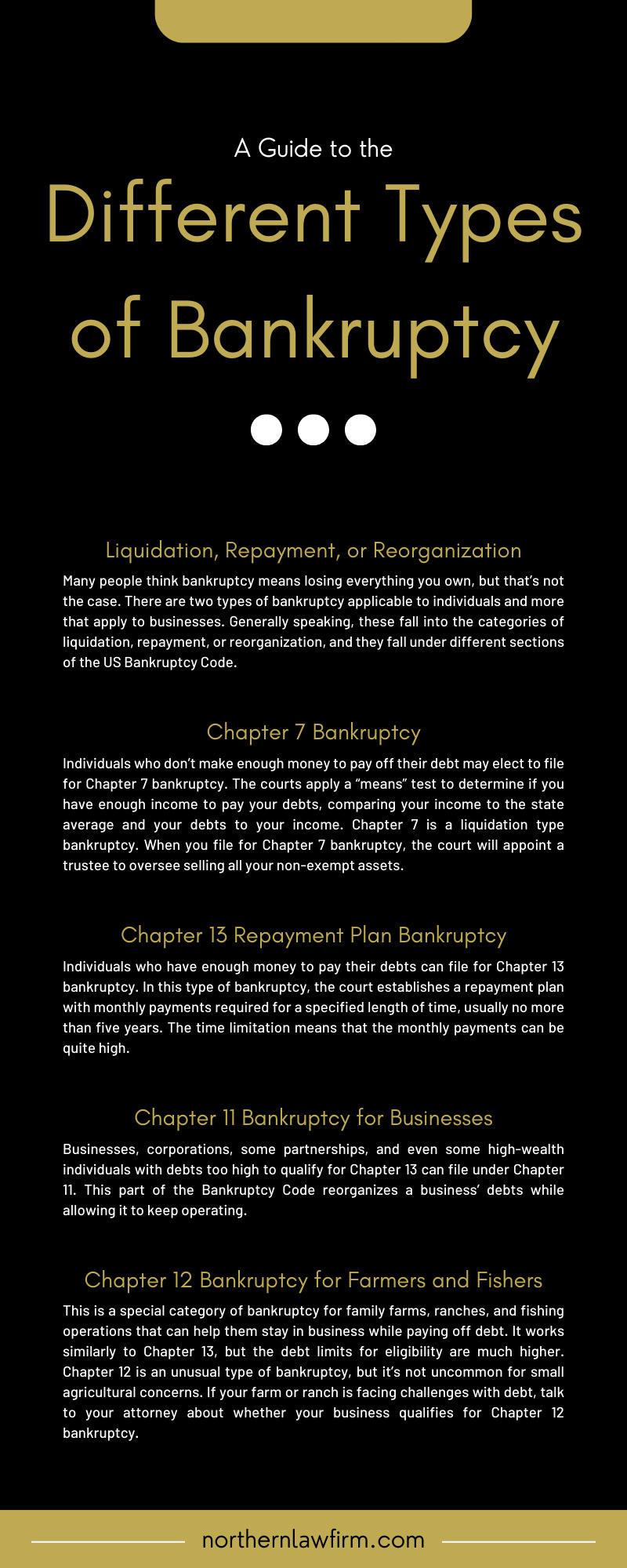

Liquidation, Repayment, or Reorganization

Many people think bankruptcy means losing everything you own, but that’s not the case. There are two types of bankruptcy applicable to individuals and more that apply to businesses. Generally speaking, these fall into the categories of liquidation, repayment, or reorganization, and they fall under different sections of the US Bankruptcy Code.

Liquidation means selling assets to pay off debt. Repayment is just what it sounds like: the bankruptcy court establishes a repayment plan to ensure creditors receive what you owe over a specified period of time.

Reorganization applies to businesses, allowing them to “restructure” their debt to enable them to pay their creditors without losing their business.

States also have their own bankruptcy and property laws. These may specify what kind of property a bankrupt individual or couple can keep in the event of bankruptcy and what they will need to sell to pay off debt.

Chapter 7 Bankruptcy

Individuals who don’t make enough money to pay off their debt may elect to file for Chapter 7 bankruptcy. The courts apply a “means” test to determine if you have enough income to pay your debts, comparing your income to the state average and your debts to your income. Chapter 7 is a liquidation type bankruptcy. When you file for Chapter 7 bankruptcy, the court will appoint a trustee to oversee selling all your non-exempt assets.

Exempt assets are the property you’re allowed to keep, which, in Texas, may include many things. Exempt assets in Texas can include your house or the amount of equity you have in your house, your car, some of your livestock, clothing, firearms, and some family heirlooms. Some of your personal property will have a cap on the value that’s exempt from liquidation.

The court can discharge “unsecured” debt (debt you owe that isn’t backed by an asset like a house, RV, or car). That can be a huge relief to people who have run up credit card bills they can’t handle, but the damage to their credit rating will follow them for years.

When you apply for Chapter 7, your financial life becomes an open book to your creditors, who have the opportunity to grill you on your financial condition and your debts. While you will no longer be in debt, your cosigners, if you have them, will be, and creditors may continue to hound them for payment.

Some businesses, like sole proprietorships, can file for Chapter 7 if there is no hope for the business to continue operating.

Every person’s situation is different, so it’s important to get advice from an experienced Texas bankruptcy lawyer to help you determine your eligibility for Chapter 7 bankruptcy and what property may be exempt. Unforgiven student loans and taxes are never exempt—you’ll have to pay those back. A Chapter 7 bankruptcy stays on your credit report for 10 years.

Chapter 13 Repayment Plan Bankruptcy

Individuals who have enough money to pay their debts can file for Chapter 13 bankruptcy. In this type of bankruptcy, the court establishes a repayment plan with monthly payments required for a specified length of time, usually no more than five years. The time limitation means that the monthly payments can be quite high.

Repayments will include a portion or the entirety of your unsecured debt. Chapter 13 bankruptcy is essentially a “reorganization” of debt for an individual, and the courts will monitor your spending and require you to adhere to a strict budget during the repayment period. The amount you must pay back will depend on your income, your debts, and your assets.

Although it’s a relief to keep your property, it’s not fun to have the court looking over your shoulder at your spending. But whether it was through job loss, a medical emergency, or otherwise, Chapter 13 gives you a roadmap to debt repayment.

There are limits on the amount of debt you can have to be eligible to file for Chapter 13 bankruptcy. Your unsecured debt must be less than $465,275, and your secured debt, like your mortgage, must be less than $1,395,875. The Bankruptcy Code established these amounts in April 2022, and they could be altered by the courts according to a three-year schedule.

Unlike Chapter 7, which exposes you to direct interrogation by your creditors even though a trustee handles the liquidation, Chapter 13 establishes a repayment plan where the debtor pays creditors through a trustee. Once a court approves the Chapter 13 bankruptcy, creditors can’t go after you for repayment anymore.

Chapter 11 Bankruptcy for Businesses

Businesses, including corporations, some partnerships, and even some high-wealth individuals with debts too high to qualify for Chapter 13 can file under Chapter 11. This part of the Bankruptcy Code reorganizes a business’ debts while allowing it to keep operating.

Both the court and the business’ creditors must approve a plan that shows how the business will keep running while also repaying its debts.

Chapter 12 Bankruptcy for Farmers and Fishers

This is a special category of bankruptcy for family farms, ranches, and fishing operations that can help them stay in business while paying off debt. It works similarly to Chapter 13, but the debt limits for eligibility are much higher. Chapter 12 is an unusual type of bankruptcy, but it’s not uncommon for small agricultural concerns. If your farm or ranch is facing challenges with debt, talk to your attorney about whether your business qualifies for Chapter 12 bankruptcy.

The Northern Law Firm is here to help you through tough financial times. Contact us today so that we can help you determine whether filing for bankruptcy might be the best course of action for you or your business.